■ Contenders for HCL-Foxconn chip plant

■ LTIMindtree CEO on firm’s margins

■ ETtech Done Deals

Ecommerce clicks dip in December, trigger growth concerns

After the festive season sale, ecommerce sales slowed down in December – and the drop is more than usual. What does this mean?

Post-festive surge: Ecommerce platforms saw a significant dip in sales volume in December immediately after the end of the festive season, triggering growth concerns among online marketplaces and brands, according to industry executives. The ongoing Republic Day sales, however, have brought some respite, with a spike in consumption demand as per early trends, people aware of the numbers said.

Also read | Ecommerce roll-up companies pause brand buyouts, seek funds for survival

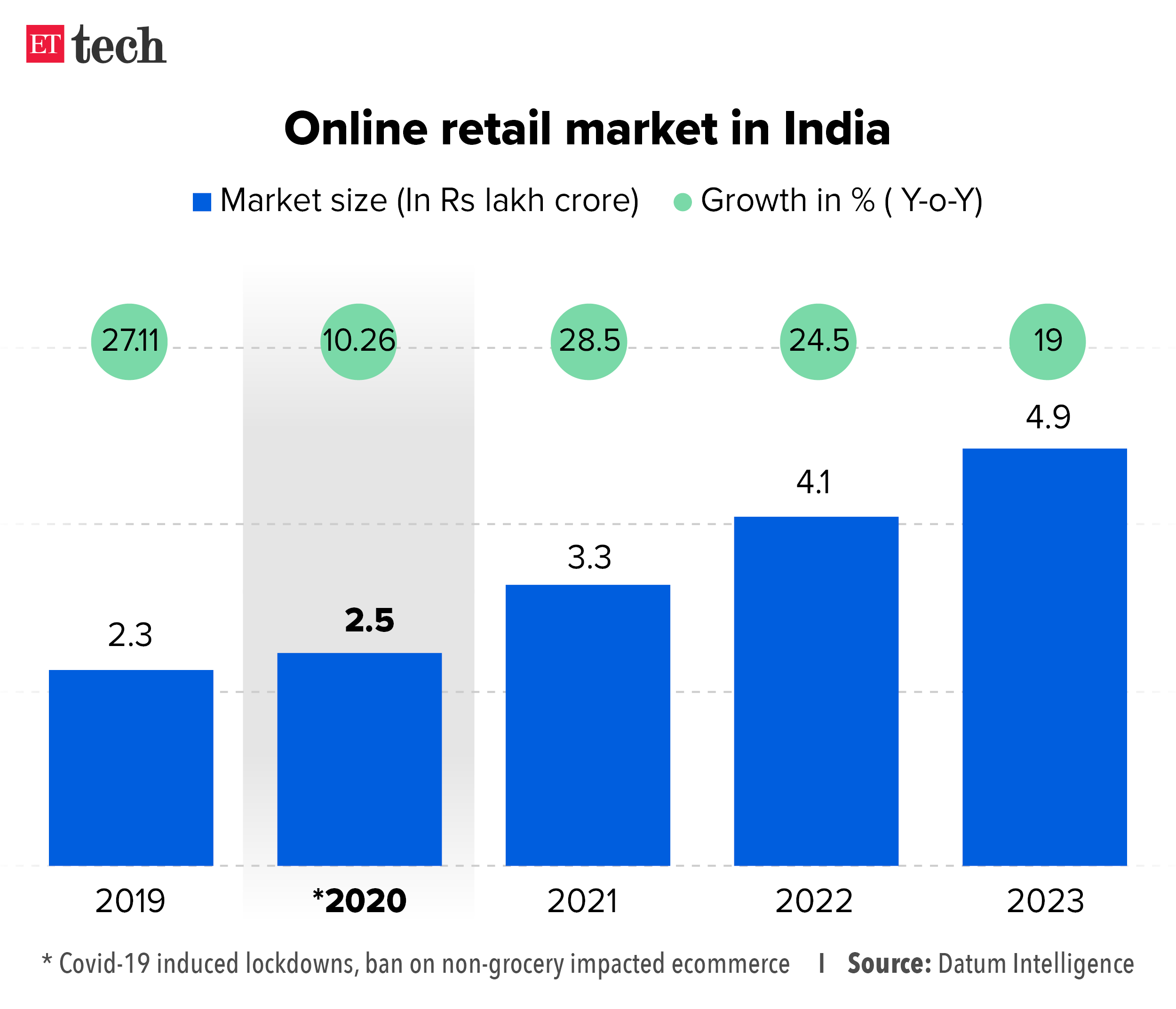

Let numbers talk: Data from market research firm Datum Intelligence showed that the ecommerce sector grew less than 20% for the first time in calendar year 2023, or about $60 billion (Rs 4.8 lakh crore) against an average growth of 25-30% in the last few years. This underscores the softness in ecommerce consumption during the first half of 2023. Due to currency value fluctuations, the growth rate differs in rupee and dollar terms.

What’s happening? Across categories — from electronics and accessories to fashion and household items — there was a slowdown in December, a top industry executive said, adding the dip was steeper than usual after a festive month. “There is softness in demand,” an industry executive told us. “Value growth can only take you so far in a big market like India; mass-market purchases need to happen. Sales data from consumer goods retailers would further validate this.”

Expert views: “Typically, post-Diwali, there is a dip in consumption because people have wrapped up the majority of spends during that period, but yes, broader data shows growth is slowing down due to multiple reasons — purchase power, offline retail being fully operational, saturation in top segments like smartphones,” said Satish Meena, an independent ecommerce analyst and advisor at Datum Intelligence.

Also read | Diwali magic: Online platforms get back their bang after muted start

Slow lane: Sequential growth in daily shipments has been sluggish, said a senior executive in the logistics industry. Post-festive sales, the business-as-usual (BAU) growth in December 2023 was in the low single-digits from the year ago, Meena said. The gradual fall in ecommerce consumption follows the spike during the Covid-19 years. Since the second half of FY22, offline has staged a major comeback, he added.

Insurtech gets into growth mode with something new…

Have you been offered flight delay insurance while checking out of an online ticket booking website? Did you find insurance bundled with your railway ticket recently? That’s because a host of tech companies are now acting as pipes to enable ecommerce applications to bundle insurance to their customers.

Driving the news: Several startups like Zopper, Riskcovry, OneAssure are enabling large consumer-facing applications like ecommerce portals, travel aggregators, and food-delivery platforms to offer insurance to their customers. They’re seeing strong growth and looking to strengthen their revenue lines, hoping to become profitable.

Also read | Insurtech startup Riskcovry gets $4.5 million in bridge round

Headline numbers: Zopper aims to process gross written premiums worth $300 million by March 2024 by working with housing finance companies, microfinance institutions, travel aggregators, retail players, ecommerce platforms and others. Riskcovry processed Rs 1,500 crore ($180 million) of gross written premiums in 2023 and aims to hit a target of Rs 2,400 crore (approximately $300 million) this year.

Also read | Banking agents take credit and insurance offerings to last mile

Context: India wants to insure all its citizens by 2047, a lofty target for a country with single-digit insurance penetration. But to make that a reality, insurance distribution needs to be redefined. That’s the big opportunity for the likes of Zopper and others.

SwissRe Institute, in a report on the sector this month, predicted that India’s insurance market will grow at a rate of 7% between 2024 and 2028, with non-life businesses growing at a compound rate of 8.3%.

…but there’s still a long way to go

Digit chairman Kamesh Goyal (left) and Acko chief executive Varun Dua

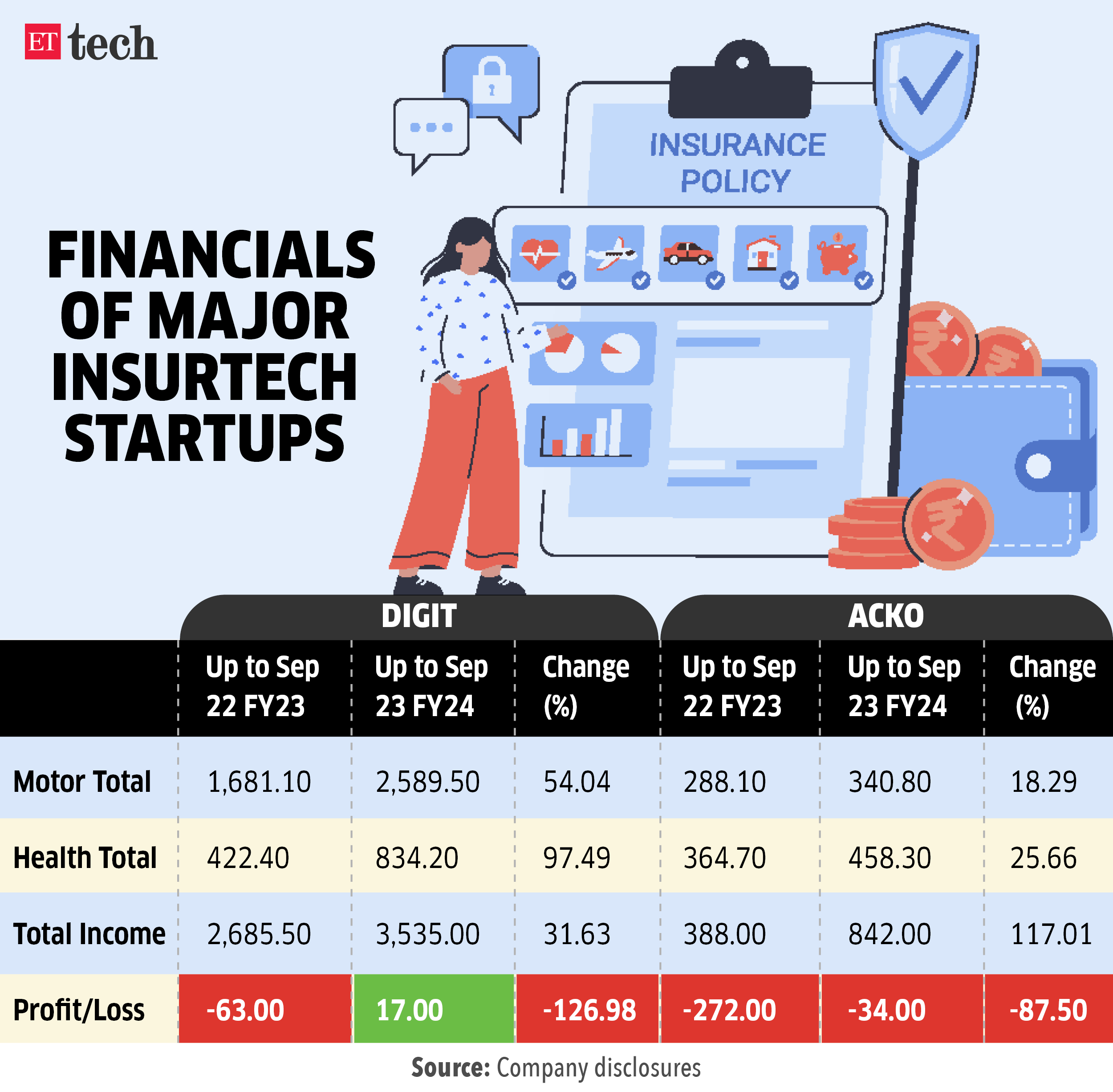

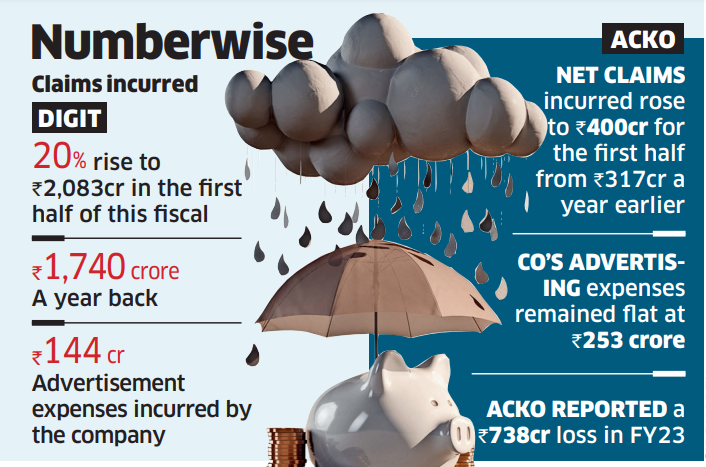

Insurtech companies are trying to control costs and improve revenue lines at the same time. After reporting a full-year profit in FY23, Digit has posted a profit for the first half of the current fiscal, too. Acko, though still loss-making, has managed to reduce it partly.

Numbers game: Digit reported a net profit of Rs 17 crore for H1 of FY24, against a loss of Rs 63 crore last year, and also nearly halved advertising expenses to Rs 144 crore. Acko reduced losses by a significant 87% to Rs 34 crore in the first half.

Business expansion: Both Acko and Digit have pushed the pedal on health insurance products. Unlike motor insurance, which is a mandatory product, health is optional. Growth in this business indicates larger adoption of these platforms. Acko saw a 25% growth in health products to Rs 458 crore, while Digit has almost doubled this business to Rs 834 crore in the first half.

What does this mean? For these tech-first insurance firms, to be able to become strong health insurance players is a pointer to the overall sustainability of the business. Also, with them becoming profitable and Digit aspiring for an IPO, it could give positive signals to an industry that is in desperate need of a complete revamp.

Tamil Nadu, Telangana on Foxconn-HCL’s radar for new chip facility

Tamil Nadu and Telangana are in “advanced-level talks” with the HCL-Foxconn joint venture to set up the latter’s recently announced semiconductor assembly and testing unit, sources told ET.

Tell me more: Sources told ET that Karnataka was also in the running, but the JV is likely to prefer Tamil Nadu or Telangana for setting up the unit, “attracted by better incentive structures” offered by those states.

Quote, unquote: “These talks are at an advanced level. Telangana also has a serious proposal and their incentive structure is also attractive. A lot depends on where the unit is finally set up, including the cost of land, the power supply stability, and environmental clearances,” a senior official told ET.

Catch up quick: ET reported on Wednesday that the facility could be set up with an initial investment of up to $150 million, excluding incentives from central and state governments. Foxconn’s share in the JV would be 40%, with an investment of $37.2 million.

Margin guidance won’t hold up this fiscal: LTIMindtree CEO

LTIMindtree managing director and CEO Debashis Chatterjee

LTIMindtree CEO Debashis Chatterjee believes muted revenues, low utilisation, and a focus on growth volumes could defer margin guidance of 17-18% by a few quarters at the country’s sixth-biggest technology outsourcing company.

Verbatim: “You have to invest and reinvest back into the business, pushing the growth a little more aggressively…Keeping all these things in mind, the initial margin target of 17% in Q4, I don’t think is going to hold. That is something we are going to defer for a few quarters,” Chatterjee said, adding the firm should be able to recover 200 basis points over a period of time.

Q3 results: Missing street estimates on Q3 performance, LTIMindtree reported a 16.8% year-on-year (YoY) increase in net profit to Rs 1,169 crore, while revenue came in at Rs 9,016 crore, growing 4.6% YoY.

ETtech Done Deals

FinAGG secures $11 million from Tata Capital, BlueOrchard: FinAGG Technologies, a fintech startup that provides working capital solutions to MSMEs, said it has raised $11 million in new funding led by Schroders-backed BlueOrchard and Tata Capital.

Alt Mobility raises $6 million in funding: Electric vehicle leasing and lifecycle management platform Alt Mobility said it has raised $6 million (nearly Rs 50 crore) in a funding round co-led by Shell Ventures, Eurazeo, EV2 Ventures and Twynam.

Other Top Stories By Our Reporters

Policy incentives helping India data centre business: NTT | Policy interventions such as the DPDP Act, RBI’s local data storage mandate, and incentives such as the data centre policies of states have boosted the long-term domestic growth prospects of firms such as NTT Global Data Centres, the firm’s India head Shekhar Sharma told ET.

ETtech Explainer: Why Byju’s pushed for arbitration in BCCI dispute | Troubled edtech firm Byju’s told the NCLT on Wednesday that it had referred its dispute with the BCCI to an arbitrator. But why did it do so?

Global Picks We Are Reading

■ Tech billionaires want to build a new city in rural California. Voters may get a say on it (Guardian)

■ The scariest sound on TikTok (The Verge)

■ AI Hits the Campaign Trail (Wired)